Adoption Tax Credit

Adoption Law

What is the Adoption Tax Credit

The Internal Revenue Code has been amended to substantially and permanently broaden the scope of the adoption tax credit for non-step-parent adoptions.

For tax year 2023, a credit of up to $15,950 of qualifying adoption expenses may be claimed where the adjusted gross income of the taxpayer(s) is $239,230 or less. The credit is gradually phased out beginning with taxpayers whose adjusted gross incomes exceed $239,230, and is eliminated for adjusted gross incomes at or above $279,230.

The family can carry any unused credit forward up to five additional tax years.

The law excludes from gross income of a taxpayer within the above income levels assistance received from his/her employer under an adoption assistance plan.

Generally speaking, when you can take the adoption credit depends on whether your child is a citizen or resident of the United States at the time the adoption effort begins.

If the eligible child is a U.S. citizen or resident, take the credit or exclusion as shown in the following tables:

Year of Payment | Tax Year in WhichYou Can Claim Payment |

Any year before the year the adoption becomes final | The year after the year of the payment |

The year the adoption becomes final | The year the adoption becomes final |

Any year after the adoption becomes final | The year of the payment |

If your child is not a U.S. citizen or resident, you cannot take the adoption credit unless the adoption becomes final. Take the credit or exclusion as shown in the following table:

Year of Payment | Tax Year in Which You Can Claim Payment |

Any year before the year the adoption becomes final | The year the adoption becomes final |

The year the adoption becomes final | The year the adoption becomes final |

Any year after the year the adoption becomes final | The year of the payment |

The 2023 adoption tax credit for a special needs adoption is also $15,950, regardless of the expenses actually incurred. This will address the inequity resulting when special needs children are adopted by parents who incur little or no direct costs as a result of the adoption process but whose indirect costs in raising a special needs child may be significant. Under the amendment, taxpayers who adopt a special needs child will qualify for the full credit regardless of their actual adoption-related expenses. The credit is claimed in the year the adoption is finalized.

The adoption credit is non-refundable. What this means is that the credit will reduce the tax liability of the adoptive family in an amount up to $15,950. If the family has no income or no tax liability, the credit will be inapplicable and the adoptive family will not benefit.

To view the general IRS discussion (may not reflect current year’s credit), go to:

www.irs.gov/taxtopics/tc607.html

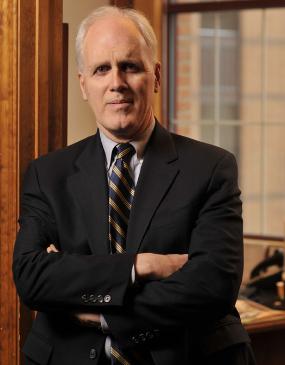

Who We Are

Located in New York's capital – Albany, our highly skilled and experienced attorneys are admitted to all state and federal courts in New York, as well as Connecticut, and the United States Supreme Court. We have the experience, knowledge and integrity to represent our clients in a competent, vigorous and professional manner.

Client success is our mission.