Adoption Law

How does a family obtain a Social Security number/card?

For a child who is/was in foster care. In New York, foster parents are able to claim foster children as dependents under many circumstances. The New York OCFS has announced procedures by which foster parents may apply for the Social Security number of their foster child. Foster parents should complete Form OCFS-4743, available from OCFS or its website, and provide the form to their county foster care or adoption worker.

For a child who is/was not in foster care. Prior to the child’s adoption, there is a likelihood that the child will not have a Social Security number. If the family wishes to claim as a dependent, or apply for the adoption tax credit, it will be necessary for the family to apply for an Adoption Taxpayer Identification Number (ATIN). This number, issued by the IRS, is a temporary taxpayer identification number for the child in a domestic adoption. It is to be used by the adopting family on their federal income tax return to identify the child while the domestic adoption is pending. Families should utilize form W-7a, application for taxpayer identification number for pending adoptions, available from the IRS website.

After the adoption has been finalized, if the birth family has not applied for a Social Security number, the adoptive family must complete an application (form SS-5) and produce documentation for the Social Security Administration proving the child's citizenship, adoption, age and identity.

For U.S. citizens ages birth through 5, there is a list of primary and secondary evidence as follows:

Primary evidence:

a. U.S. state-issued non-driver identity card

b. U.S. passportSecondary evidence:

Secondary evidence:

a. U.S. Military I.D.

b. Certificate of citizenship

c. Certificate of naturalization

d. U.S. Tribal enrollment card

e. Final Adoption Decree issued by the court where the recent adoption occurred showing in addition to the child's name, the child's date of birth or the names of the adoptive parents

It is recommended that the adoptive family bring the adoption order, if available, because it lists the child's name at birth, as well as any supporting documentation.

Please note that the above list does not include the birth certificate. Nonetheless, we have learned that some Social Security offices require that the birth certificate be produced. Accordingly, we recommend that adoptive parents call their Social Security Office ahead of time to ask if the production of the birth certificate is required.

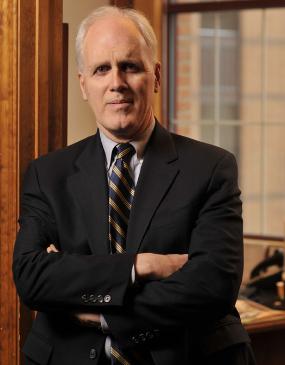

Who We Are

Located in New York's capital – Albany, our highly skilled and experienced attorneys are admitted to all state and federal courts in New York, as well as Connecticut, and the United States Supreme Court. We have the experience, knowledge and integrity to represent our clients in a competent, vigorous and professional manner.

Client success is our mission.